April 2016 – “We cannot pass on falling oil prices,” says the German adhesives industry. “Since our starting raw materials are not crude oil at all but extensively refined intermediate products, the drop in the oil price has practically no effect on our business,” representatives of the German Adhesives Association (IVK) assert. In this interview, IVK’s Chief Executive Officer Ansgar van Halteren, Dr. Bernhard Momper of Celanese GmbH and Klaus Kullmann and Dr. Christian Terfloth of Jowat SE give their views on the world market situation.

Crude oil prices have been falling for two years, and the dollar-per-barrel rate is currently 35 percent below last year’s level. Crude oil now only costs one-third of what it did in 2013. Why has the price of adhesives not dropped to the same extent?

Ansgar van Halteren: This question is often put to us in meetings with customer organisations and business journalists. But many experts know that the price of crude oil no longer bears a direct relation to that of the end products. One reason for this is that there are “adhesive families” which are completely independent of mineral oil. I’m thinking here of adhesives based on natural-sourced raw materials such as casein or starch as well as systems based on glutinens.

Klaus Kullmann: Regarding the crude oil-based raw materials, it is the number of refinement steps that determines the costs. Take the base chemicals required for polyurethane adhesives, for example. It takes up to ten refinement stages to produce them from natural gas or crude oil. In addition to that, the availability of a commodity on the market has become a crucial factor and a major price determinant. This availability is heavily influenced by technical events, like the temporary shutdown of one or more production lines. One recent example is vinyl acetate monomer (VAM), which is used as a raw material for hot melt and dispersion adhesives, amongst others.

Van Halteren: These unplanned production outages, so called force majeure cases, lead to shortages which generally drive up the price of the base materials.

Kullmann: Adhesive manufacturers neither buy nor sell any mineral oil. The causality that is sometimes assumed simply does not exist in that form. We did not bump up our prices to 150% when oil prices rocketed. And even with the current drop to 30 dollars per barrel, there can be no similar reduction in adhesive prices.

Dr. Bernhard Momper: Crude oil is first cracked to obtain naphtha. From that point on there are a number of different refinement stages – some of them involve relatively simply chemistry, others are highly complex. For higher-quality products such as polyurethane or epoxy adhesives, anything can happen in the ten value adding stages from crude oil to base material. There may be plant outages or bottlenecks for important intermediate products, which can lead to price explosions. As a result, there is less and less direct connection to the price of crude oil. More than ever before, prices are determined by the supply and demand for the base chemicals derived from the fossil resources. Crude oil is just one basis; the supply of commodities also hinges on gas in the USA and coal in China.

The price of crude has dropped to one-third of its 2013 level. Why is this not reflected at all in the price of intermediates?

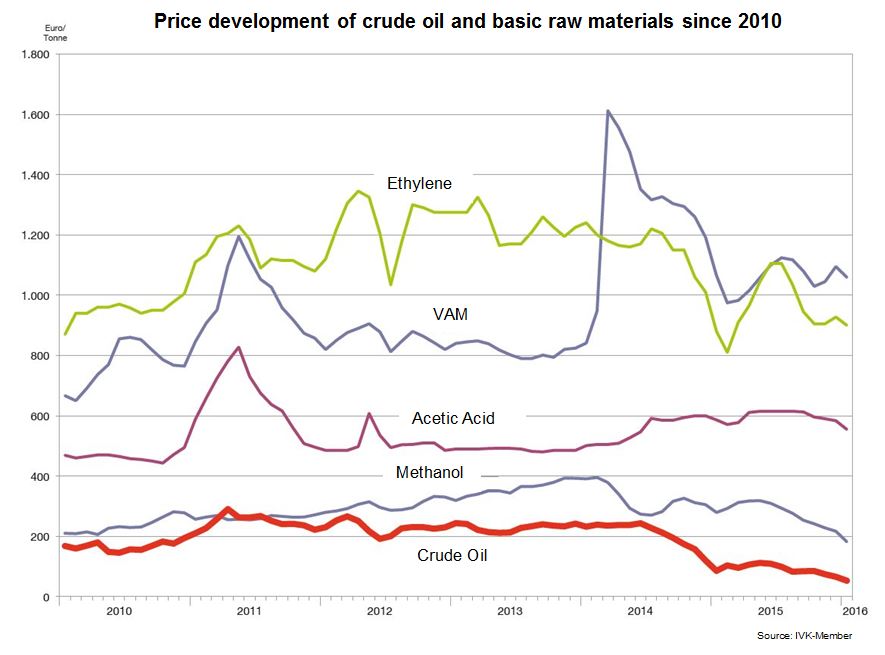

Momper: I have an overview here of the price trends for essential base chemicals and for crude oil. Do you see any correlation there?

→ Chart showing price trends of crude oil and base commodities since 2010

Indeed, there is none. However, in the past steep rises in crude oil prices have been quoted by some as the reason for price adjustments.

Momper: That may be – before the turn of the millennium. Market dynamics have changed considerably since then. Today certain base chemicals have become scarce in Europe. One could say that petroleum cracking plants are dying out in Europe as ageing plants are successively closed down, whereas in other regions people are investing in new gas crackers. There has been a shift in the global provenance of important commodities such as methanol, ethylene, propylene, acetic acid, acrylic acid and butadiene. Old plants that are no longer profitable are being closed down. And for a number of reasons spending has increased in other regions, not just Asia, with investment in expansions and in newbuild projects. Europe has become a net importer of many base chemicals. Vinyl acetate, for example, now has to be imported in large quantities from the USA and Asia. European demand can no longer be met by the output from European plants alone. This commodity is a key raw material for polyvinyl alcohol, vinyl acetate homopolymers and VAE dispersions that are used in many wood glues and packaging adhesives. And when there is a force majeure like the plant outage in 2014, the resulting shortages cause the prices for vinyl acetate to go through the roof.

Kullmann: We had a similar problem with ethylene, which is very important for us. This was already a scarce commodity – because we use large volumes of polyethylene, because there are less crackers in Europe, and because the remaining ones produce more propylene than ethylene. Then in the spring of 2015 there was a force majeure at Shell. The ethylene shortage also caused the availability of vinyl acetate to sink. And the same thing happened with ethylene oxide, again due to a force majeure. Ethylene oxide is used for emulsifiers. Without them, it suddenly became impossible to produce a number of different dispersions. There has been a whole string of force majeures in Europe over the past five years.

So there are more plant outages than before?

Dr. Christian Terfloth: It certainly feels like that because there are less plants in operation. But it is not just shutdowns that cause bottlenecks. Major overhauls in one of the remaining plants can also affect the availability of scarce raw materials.

Momper: Acrylates throw a whole new light on matters. We need them for soft acrylic dispersions and pressure sensitive adhesives (or PSAs). However, they are also needed in large quantities to make binders for paints and coatings. When the construction boom starts slackening in China and there is less demand for interior and exterior paints, Asia will be swimming in acrylates and will begin shipping them to Europe. Ultimately, demand in a totally different segment can also steer prices.

Van Halteren: And then there is ethylene vinyl acetate: for years the photovoltaic industry bought vast quantities for its solar panels, and paid a lot of money for it. The adhesives industry suffered from that too. Another example is acrylic acid. This is not just used for adhesives but for superabsorbers as well. So we have to compete with the diaper industry for this raw material!

Why is there such a shortage of base chemicals for the adhesives industry in Europe?

Momper: The age of investing in large-scale petrochemical plants in Europe is quite simply over. Given the energy costs we have here, no one can afford it. Celanese recently expanded the vinyl acetate facilities in the USA. New investments have been made in vinyl acetate and acetic acid capacities in Asia, but not here in Europe.

Kullmann: We have a steadily increasing demand for adhesives in Europe, but the chemical plants for the base materials are ageing, at about 50 years old on average. Maintenance and repair costs are correspondingly high. Nevertheless, it is not worth investing in renewal either. Investment decisions are going against Europe. And that is not just because of the high energy costs. The legal framework puts us at a disadvantage as a location.

How dependent is the adhesives industry on crude oil today?

Van Halteren: We produce 860,000 tonnes of adhesive in Germany. If I subtract glutinen glues and other natural-sourced adhesives such as casein and dextrin, that still leaves approx. 760,000 tonnes. 80 percent of adhesives are actually based on petrochemicals – in other words, chemicals derived from fossil sources, which include coal and natural gas as well as crude oil. Ultimately, however, pricing has nothing to do with the source of raw materials but with knock-on effects from other industries.

The interviewees

Ansgar van Halteren is Chief Executive Officer of the German Adhesives Association (IVK) in Düsseldorf.

Dr. Bernhard Momper, Application Technology Manager at Celanese GmbH, Frankfurt, is a board member of IVK and chairman of the IVK working group on raw materials.

Klaus Kullmann is a board member of Jowat SE, Detmold, and also an executive board member of IVK.

Dr. Christian Terfloth is a board member of Jowat SE, Detmold, and is a member of the technical board at IVK.

The interviewer was the technical author Rainer Dettmar